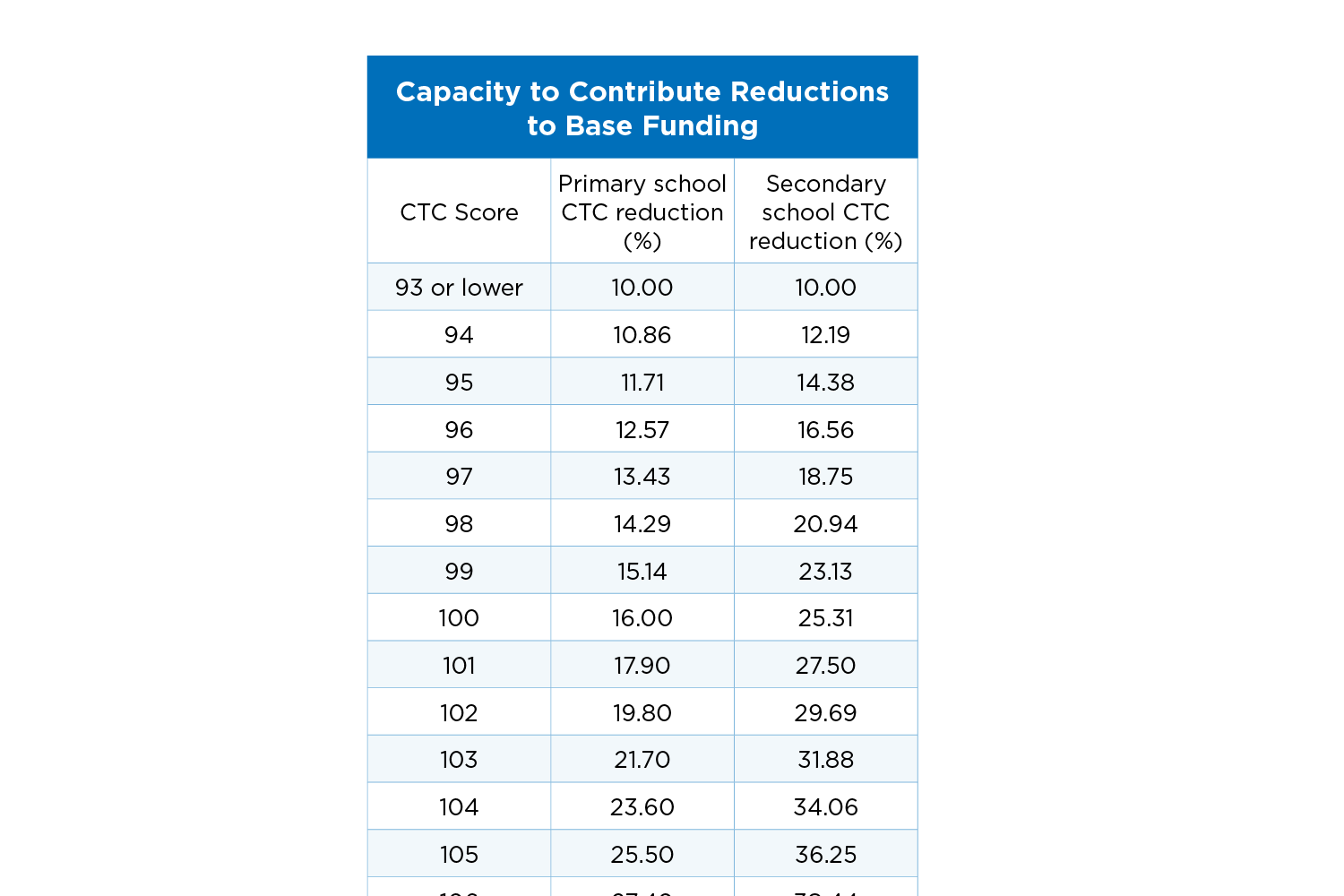

- Exemptions from CTC discounts: Special schools, Special Assistance Schools, majority Aboriginal and Torres Strait Islander schools and sole-provider schools do not have their funding reduced according to parents’ income. There is also no CTC-based reduction for Distance Education students, who attract 45% of the SRS funding amount to their school’s base amount.

- No limit to government funding each year: The school funding totals in State and Federal Budgets each year are merely estimates; they are not a limit on the amount of funding available. If a sector enrols more students than expected, the government simply provides more funding to that sector. Likewise, if a sector enrols fewer students than expected, the government reduces its funding to that sector. No school or sector ever misses out, because school funding never ‘runs out’.

- Schools attract funding, but don’t receive it. Funding is calculated for each school, but it goes to the school’s owner, not the school. If an owner has a ‘system’ of schools, eg a Department of Education or a diocesan Catholic Education Office, the funding attracted by all their schools is pooled. The owner then provides each school with the staff and other resources it needs.

|

- Accountability and transparency: All schools report their public and private income and expenditure annually through a Financial Questionnaire. A summary is published on the MySchool website. The Commonwealth also conducts a random audit of some 300 schools per year to ensure funding is provided accurately.

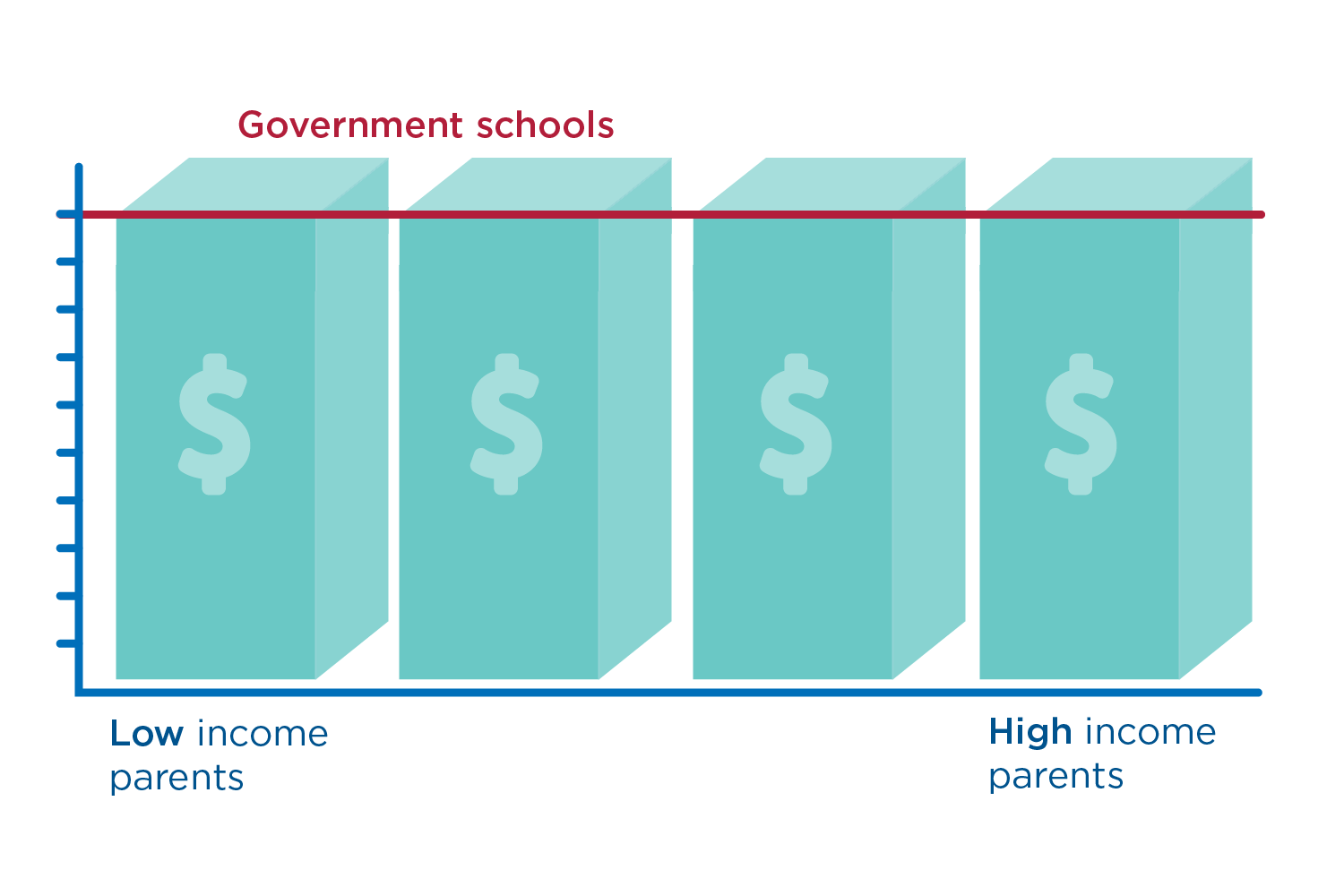

- Additional income for Government schools: Government schools can raise funding through voluntary fees, hire of school facilities, etc without losing any of their government-funded SRS entitlement.

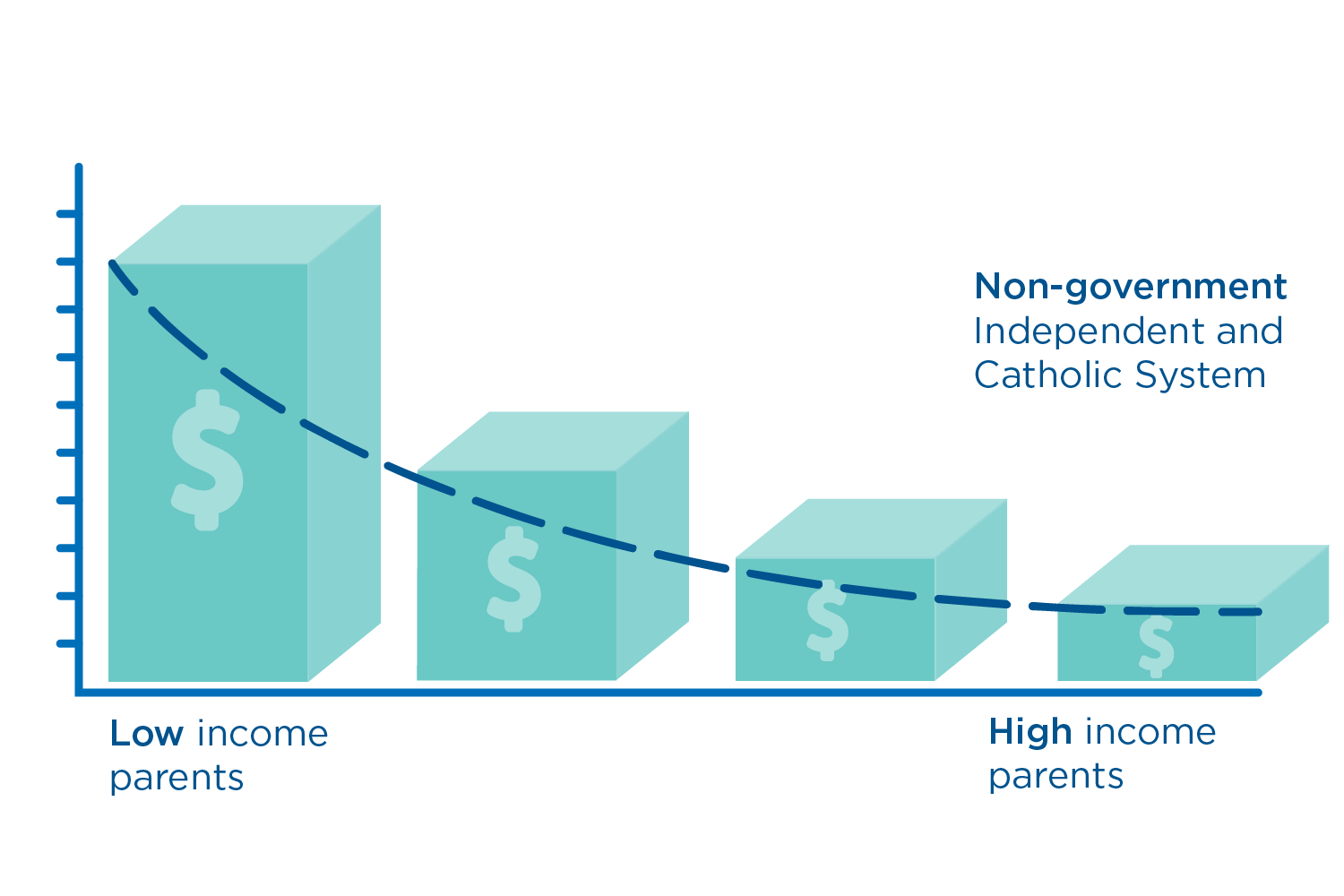

- School fees: Non-government schools can set fees as low or as high as they wish. It has no bearing on their government funding entitlement, which is based only on parents’ Capacity to Contribute (the median fee collected in NSW Independent schools is less than $6,000 per year).

|